Payroll tax calculator 2020

Ad Process Payroll Faster Easier With ADP Payroll. Federal Salary Paycheck Calculator.

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

You can use our calculators to determine how much payroll tax you need to pay.

. Ad Accurate Payroll With Personalized Customer Service. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or.

Ad Easily and efficiently track and manage all your tax filings and projects in your office. States dont impose their own income tax for tax year 2022. What does eSmart Paychecks FREE Payroll Calculator do.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Discover ADP Payroll Benefits Insurance Time Talent HR More. Get a free quote today.

GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. The maximum an employee will pay in 2022 is 911400.

To utilize the spreadsheet you. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Get a free quote today.

Starting as Low as 6Month. Ad Process Payroll Faster Easier With ADP Payroll. Free salary hourly and more paycheck calculators.

3 Months Free Trial. Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. Ad Get the Payroll Tools your competitors are already using - Start Now. All inclusive payroll processing services for small businesses.

Many states do not release their current-tax-year 2021 brackets until the. Ad Compare This Years Top 5 Free Payroll Software. Get Started With ADP Payroll.

Median household income in 2020 was 67340. Plug in the amount of money youd like to take home. The Use Tax Calculator Worksheet Excel spreadsheet is a free tool to help individuals and businesses track and calculate use tax owed to Wisconsin.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Free Unbiased Reviews Top Picks. Get Your Quote Today with SurePayroll.

It will confirm the deductions you include on your. All of our bracket data and tax rates are updated yearly from the IRS and state revenue departments. Use your income filing status deductions credits to accurately estimate the taxes.

Our payroll check-writing service handles weekly bi-weekly semi-monthly or monthly payroll checks along with preparing all monthly quarterly and yearly payroll tax forms including year. Determine if you could maintain your current standard of living in a different city. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Make sure you never miss another filing date and help your firm run smoothly. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Calculate your liability for periodic annual and final returns and any unpaid tax interest UTI. Compare the cost of living in two cities using the CNNMoney Cost of Living calculator. All Services Backed by Tax Guarantee.

The payroll tax rate reverted to 545 on 1 July 2022. Thats where our paycheck calculator comes in. Get Started Today with 2 Months Free.

Small Business Low-Priced Payroll Service.

Salary Formula Calculate Salary Calculator Excel Template

Payroll Tax Calculator Shop 55 Off Www Wtashows Com

Taxable Income Formula Examples How To Calculate Taxable Income

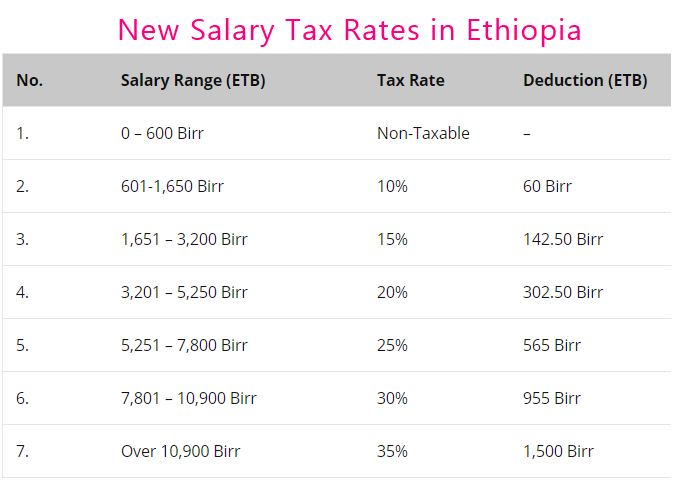

Salary Income Tax Calculation In Ethiopia Payroll Net Pay Pension Cost Sharing Calculator With Examples Addisbiz Com

What Are Employer Taxes And Employee Taxes Gusto

Tax Payroll Calculator On Sale 55 Off Www Wtashows Com

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Payroll Tax What It Is How To Calculate It Bench Accounting

Income Tax Calculator 2020 Income Tax Income Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Income Tax Withholding Tables Changes Examples

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Payroll Tax Calculator Best Sale 59 Off Www Wtashows Com

Salary Formula Calculate Salary Calculator Excel Template

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Taxable Income Formula Examples How To Calculate Taxable Income